Mistrust and lies ruin relationships admit private equity fund managers and their investors in The Reputational Risk in Private Equity Report

- 100% of LPs reviewed a fund due to poor GP communications

- 52% of LPs reviewed a fund following poorly communicated personnel changes

- 63% of LPs met a GP even though they had no intention of investing in its fund

- 16% of LPs admit lying to GPs about why they didn’t invest in their fund

London, 05 November 2014: General Partners (GPs) are highly suspicious of their Limited Partner (LP) investors, with 84% believing that LPs have lied about why they won’t invest, according to The Reputational Risk in Private Equity Report (The RRiPE Report) 2014. Lifting the lid on the difficulties of fundraising and maintaining relationships, 128 LPs and 101 GPs give a unique insight into the state of today’s global private equity fund reporting and communications.

The RRiPE Report 2014 analyses the relationship between GPs and their LP investors and assesses how well each side communicates with the other before, during and after fundraising. The survey was commissioned by IAG UK Limited. IAG UK is a joint venture between IAG and Thompson Taraz with offices in Mayfair, London.

- Although only 16% of LPs admitted lying about the reason for not investing, 63% said they met a GP despite having no intention of investing in that fund.

- Over 90% of GPs thought an LP met them only to benchmark their fund. However, just under a third of LPs admitted taking the meeting just to benchmark.

- Some 80% of GPs suspect LPs of requesting extra data and then not using it, but only a third of LPs admitted doing this.

Commenting, Raymond Page, Director IAG UK, said: "When it comes to communication, there are eye-opening differences between LP expectations, the reality of what they experience and GP perceptions of how well they are doing. The undertone of mistrust that the report has highlighted cannot be beneficial to the manager/investor relationship. With fierce competition for investors, fund managers must spend quality time with their LPs early on in the relationship to discuss and agree communication needs and preferred fund report formats."

Quality of fund reports

Fewer than 50% of LPs believe they get all the information they need from fund performance reports, whereas 90% of GPs think their reports are complete. Revealing the frustrations of fund reporting, almost two-thirds of GPs have had requests to re-format reports with a similar number reporting LPs requesting extra portfolio information. One GP reported 9,000 supplementary data requests in one year.

Poor communication has led 100% of all the LPs surveyed to review a fund. Examples of poor GP communications (with GP opinions in brackets) include:

- Personnel changes – 52% (30% said GPs)

- Inaccurate or incomplete reporting – 42% (only 12% of GPs admitted this)

- GP reputation issues – 41% (a mere 4% of GPs concurred)

- Portfolio reputation issues – 39% (19% of GPs agreed)

- Slow response to enquiries – 40% (also 40% GPs owned up)

- Poor governance – 40% (just 3% of GPs agreed)

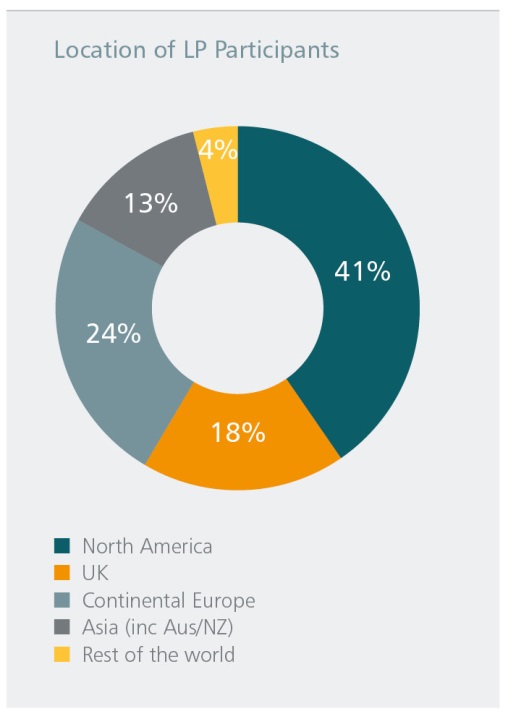

LPs regard venture capital fund managers as the worst for the quality of their fund reports while established private equity fund managers are considered the best. UK private equity fund managers were the best group by region, marginally beating their North American counterparts, according to the 101 LPs surveyed from 26 countries.

Ends

A Pdf copy of the report is available here and infographics on the data are available on request.

For further information, please contact:

Ingrid Tighe, Pivot Partners on 07962 276580 or Ingrid@pivotpartners.co.uk

Notes to Editors

The Reputational Risk in Private Equity Report (RRiPE) 2014

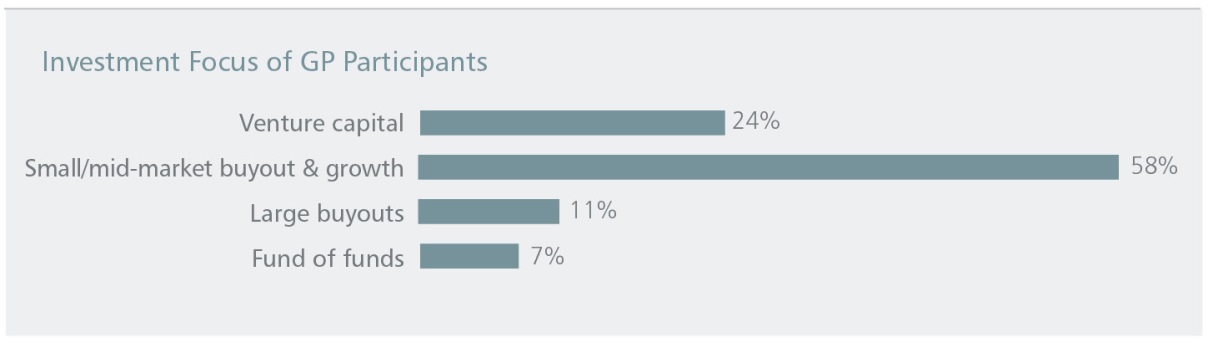

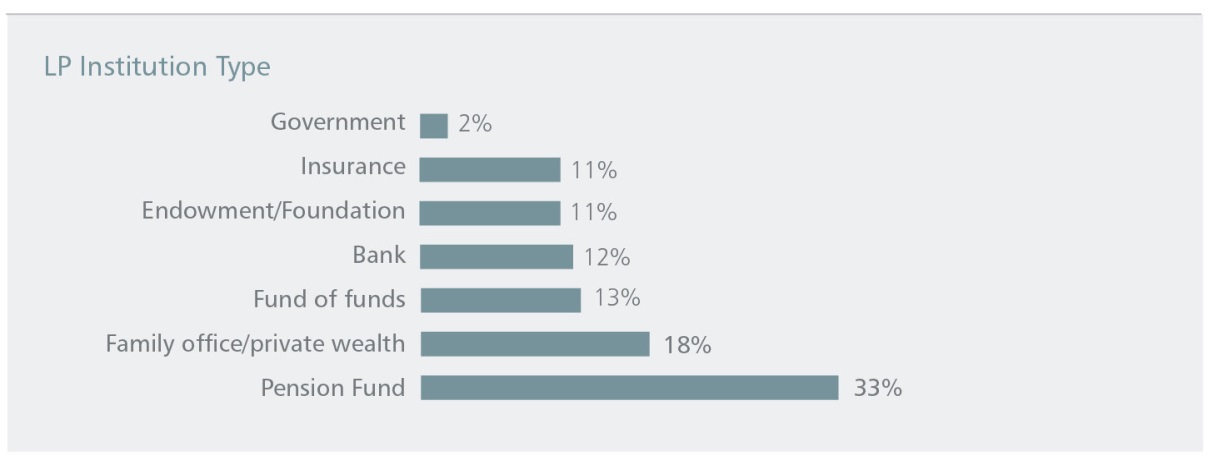

101 GPs and 128 LPs took part in the research study in June and July 2014.

Type of firm:

Location:

About IAG:

www.iagfundservices.com

Headquartered in Guernsey, IAG delivers specialist fund administration services for private equity, real estate, alternative assets and listed corporate structure. Clients are served by a highly skilled team led by a board director. Since its inception, IAG has administered over 400 funds and globally has assets under administration of over $12bn.

IAG has the knowledge and know-how to provide the best solutions to fund promoters and managers, expertly delivered by a team who take personal pride in going the extra mile to advise and support IAG’s clients.

International Administration Group (Guernsey) Limited and IAG Private Equity Limited are licensed by the Guernsey Financial Services Commission.

About Thompson Taraz:

www.thompsontaraz.co.uk

Thompson Taraz is a leading UK fund services group offering fund administration, PE Depositary, third party fund management, and related fund consulting services. Thompson Taraz has been a regulated operator and manager of UK funds for over 10 years.

Thompson Taraz launched its PE Depositary and AIF Manager solution for private equity and real estate funds earlier this year. Thompson Taraz also provides tax and structuring advice through its Chartered Accountancy practice.

Thompson Taraz Collectives Limited and Thompson Taraz Managers Limited are authorised and regulated by the Financial Conduct Authority. Thompson Taraz LLP is registered to carry on audit work in the UK by the Institute of Chartered Accountants in England and Wales.